Heloc principal and interest payment calculator

Principal Interest Ending Balance. This is the annual interest rate youll pay on the loan.

What To Know About Fixed Rate Helocs And How They Work Credible

However you cant deduct the prepaid amount for January 2022 in 2021.

. 843 - 500 343. An interest-only home equity line of credit HELOC is when you make payments on the interest first for a number of years while you are drawing funds on the credit line. Once the HELOC transitions into the repayment period you arent allowed to withdraw any more money and your monthly payment will include principal and interest.

Enter your loans interest rate. How to pay off your HELOC. Heres how it works.

HELOC Payment Calculator With Amortization Schedule is used to calculate monthly payment for your HELOC loan. Interest-only Loan Payment Calculator This calculator will compute an interest-only loans accumulated interest at various durations throughout the year. Balloon payments are common for interest-only loans where your monthly payments go to pay interest and do not pay down any of the principal.

Monthly Principal Interest Payment CHB RATE 1 RATE 12 RP 1 RATE 12 RP - 1 Where. See Prepaid interest earlier You will have to figure the interest that accrued for 2022 and subtract it. How to calculate HELOC payments.

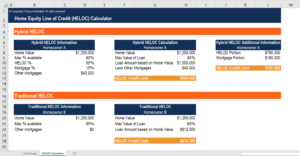

Lower Your Interest Expenses. The Home equity line of credit calculator will show you an HELOC amortization schedule excel that you can view all the payments each month. Use Zillows home loan calculator to quickly estimate your total mortgage payment including principal and interest plus estimates for PMI property taxes home insurance and HOA fees.

When you pay off part of the principal those funds go back to your line amount. Then comes the repayment period when as the name. HELOCs tend to have variable interest rates while home equity loans are fixed.

Since borrowers only pay interest in the interest-only period the HELOC amortization schedule for that period will be just for interest payments and 0 for the principal. A portion of each payment goes to interest and the principal amount of the loan. A HELOC can help you to lower your debt payments by lowering your interest rate.

CHB Current HELOC Balance. As your payments during the draw period are applied to the principal amount you owe your available credit increases. This HELOC calculator is designed to help you quickly and easily calculate your monthly HELOC payment per your loan term current interest rate and remaining balance.

This is a payment usually due at the end of the loan thats often much larger than your usual monthly payment. If you would like to calculate the size of the home equity line of credit you might qualify for please visit the HELOC Calculator. See the remaining balance owed after each payment on our amortization schedule.

Home equity loan rates are between 35 and 925 on average. Once the draw period ends the repayment period begins. The calculator returns your estimated monthly payment including principal and interest.

Some HELOCs allow you to make interest-only payments for a defined period of time after which a repayment period begins. The HELOC payment calculator generates a HELOC amortization schedule that breaks down each monthly payment with interest and the principal amount that a borrower will be paying. The payment amount includes both principal and interest minimum of 100.

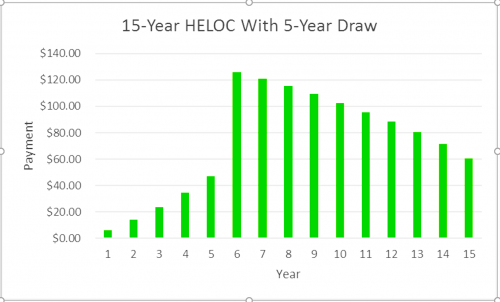

HELOCs have two parts. The monthly payment for a HELOC is divided into two phases based on the point of time during the HELOC. After your draw period ends you enter a 10- to 20-year repayment period during which youll make payments on interest and the principal.

It is possible that a calculation may result in a certain monthly payment that is not enough to repay the principal and interest on a loan. Enter the price of a home and down payment amount to calculate your estimated mortgage payment with an itemized breakdown and schedule. This calculator will help you to determine the principal and interest breakdown on any given payment number.

The monthly required payment is based on your outstanding loan balance and current interest rate interest rates can increase or decrease and may vary each month. See what a HELOC costs per month Repaying a Home Equity Line of Credit HELOC requires payment to the lender which typically includes both repayment of the loan principal plus monthly interest on the outstanding balance. Prepaid interest on Form 1098.

This free online calculator will calculate the monthly interest-only HELOC payment given your current balance plus calculate the principal and interest payment that will take effect once the draw period expires. This calculator can also estimate how early a person who has some extra money at the end of each month can pay off their loan. Interest Paid Principal Paid Total Payment Remaining Balance.

The minimum monthly payment shown in your results reflects interest-only monthly payments. When the draw period ends you enter the repayment period where you begin paying back the remaining principal on your HELOC plus interest. First is the draw period during which you borrow money and make payments against the interest.

A mortgage rate is the interest rate you pay on the money you borrow to buy property. Our HELOC payment calculator provides the monthly payment required for a home equity line of credit HELOC. Sept 2022 000 14375 Oct 2022 000 14375 Nov 2022 000 14375 Dec 2022.

Payment Interest Principal Balance. At this point you can no longer borrow money. Use our free amortization calculator to quickly estimate the total principal and interest paid over time.

For example on October 8 2020 the national average interest rate for a 30-year fixed rate mortgages was 287 percent while the average credit card interest rate on cards assessed interest stood at 1643 percent in August 2020. Enter the loans original terms principal interest rate number of payments and monthly payment amount and well show how much of your current payment is applied to principal and interest. Compare todays mortgage rates for purchase and refinance and lock in the best deal on your home loan.

Age of the loan. Find out if your loan terms say youll owe a balloon payment. Typically the term of an equity loan term can be anywhere from five to 30 years but the length of the term must.

Simply add the extra into the Monthly Pay section of the calculator. Actual payments may vary. These amounts reflect the amount which would need to be paid in order to maintain a constant principal balance.

If you prepaid interest in 2021 that accrued in full by January 15 2022 this prepaid interest may be included in box 1 of Form 1098.

Looking For A Heloc Calculator

Mortgage Payoff Calculator With Line Of Credit

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Heloc Calculator Calculate Available Home Equity Wowa Ca

Home Equity Line Of Credit Heloc Rocket Mortgage

Heloc Calculator

Home Equity Loan Calculator By Creditunionsonline Com Calculate Home Equity Loan Payments

Home Equity Line Of Credit Qualification Calculator

Will Your Heloc Payment Skyrocket When The Draw Period Ends Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Home Equity Line Of Credit Heloc Rocket Mortgage

How A Heloc Works Tap Your Home Equity For Cash

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Line Of Credit Heloc Calculator Overview

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Heloc Payment Calculator With Interest Only And Pi Calculations

Home Equity Calculator Free Home Equity Loan Calculator For Excel